2/15/2017

Contact Us

The Surplus Line Association of Arizona

14747 N. Northsight Blvd., Suite 111-449

Scottsdale, AZ 85260

Tel:1-602-279-6344

Email:[email protected]

*** Please email trouble reports to [email protected] ***

*** Internet Explorer Users: if you are having problems please turn on compatibility mode ***

Recent News

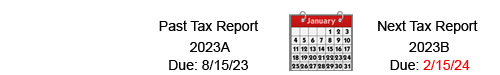

1/1/2024 – 2023B reports will be available starting January 8, 2024.

By Feburary 15, 2024, you must report transactions to SLA, and file reports and pay premium tax to the Department of Insurance, as follows:

- Only file, report and pay tax on transactions for which Arizona is the “home state.”

- File transactions and run the 2023B report for insurance procured between July 1 through December 31 2023

- All reports must be submitted through OPTins (www.optins.org) using the Excel version of the tax report we automatically email you when you run your report.

8/22/2020 – Arizona Department of Insurance

Starting July 1, 2020 the Arizona Department of Insurance has become the

Department of Insurance and Financial Institutions (DIFI). Their correct address is:

Department of Insurance and Financial Institutions

100 North 15th Avenue, Suite 261

Phoenix, AZ 85007-2630

(602) 364-3999

10/1/2018 – Please take note of our new mailing address 14747 N. Northsight Blvd., Suite 111-449 Scottsdale, AZ 85260.

9/1/2018 – The Surplus Line Association of Arizona will have a new address effective 10/1/2018. Please see the this bulletin for more details New Address effective 10/1/2018

8/16/2016 – Important information about

Tax Exempt Classes

Frequently Asked Questions

- How do I file transactions with the Arizona Surplus Line Association?

- Register to use the online filing system by clicking the File Online Now button in the upper right then clicking the “Register” button in the upper right corner of that page. After you have registered, our office will activate your registration (usually the same day).

Login to the system and review all of the information on the "Help" tab for instructions on how to use the system. - What is Arizona's surplus lines tax rate?

- 3.0% -- payable to Insurance Tax Section and submitted to the Arizona Department of Insurance and Financial Institutions, Attn: Insurance Tax Section. Do not combine your tax payment with any other payment you may be required to make. Your tax payment must be submitted with a tax report generated from our system.

- What is the Arizona Surplus Line stamping fee rate?

- 0.2% - payable to The Surplus Line Association of Arizona (NOT to the Arizona Department of Insurance and Financial Institutions). When you report a transaction using our system, we will send you an e-mail that shows the stamping fee you need to pay.

- What are Arizona's surplus lines tax filing requirements?

- For detailed "Surplus Lines Transaction Report and Tax Payment Instructions", click on the "Forms and Instructions" menu item in the left column of this page.

- Is Arizona participating in a compact or agreement that requires multi-state transactions to be filed with a central clearinghouse?

- No – Arizona is not currently participating in a compact or agreement for multi-state transactions. Accordingly, you must:

File with The Surplus Line Association of Arizona all transactions for which Arizona is the home state

Pay (To the Surplus Line Association of Arizona) the stamping fee invoice you receive for filed transactions

Before February 15th (for transactions procured the previous July 1 through December 31) or before August 15 (for transactions procured the previous January 1 through June 30), generate statements of surplus line transactions and generate tax reports using our online system; and file the statement of surplus line transactions with your tax report and payment to the Insurance Tax Section of the Arizona Department of Insurance, either using the OPTins electronic filing system (www.optins.org) or by mail (Insurance Tax Section, 100 N. 15th Avenue Suite 102, Phoenix, AZ 85007-2624).

Surplus Line Association

President

Konnie Keaschall-Kiser, RPLU, ASLI, CIC

Burns & Wilcox of Arizona

Vice President

Edward Dresselhuys

USI Insurance Services of Arizona

Secretary Treasurer

Marc Adler

Private Consulting

Our Board

Terri S. Edwards CIC, CISR

Independent Insurance Agents and Brokers of Arizona

Erick L. Johnson CPCU, ARM, AFSB

Southwest Insurance and Risk Advisors, LLC

James Mann

Private Consulting

Teresa K. Quale CPCU, CIC

Sonoran National Insurance Group

J. Scott Wede, CPCU, ASLI

Executive Director